rhode island income tax rate 2020

And the tax return that. Rhode Island Tax Brackets for Tax Year 2020.

Taxation Of Social Security Benefits Mn House Research

2022 Federal Tax Brackets.

. Rhode Island also has a 700 percent corporate income tax rate. The tax rates range from between. Apply the taxable income computed in step 5 to the following.

District of Columbia state income tax rate table for the 2020 - 2021 filing season has six income tax brackets with DC tax rates of 4 6 65 85 875 and 895. However if Annual wages are more than 231500 Exemption is 0. Start filing your tax return now.

Rhode Islands tax system ranks 40th overall on our 2022 State Business Tax Climate. Looking at the tax rate and tax brackets shown in the tables above for Rhode Island we can see that Rhode Island collects individual. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022.

Household income location filing status and. Rhode Island Tax Brackets 2022 - 2023. Detailed Rhode Island state income tax rates and brackets are available on.

Like most states with income tax it is calculated on a marginal scale with multiple brackets 3. This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax. Rhode Island state income tax rate table for the 2020 - 2021 filing season has three income tax brackets with RI tax rates of 375 475 and 599 for Single Married Filing Jointly.

RHODE ISLAND TAX RATE SCHEDULE 2020 TAX RATES APPLICABLE TO ALL FILING STATUS TYPES Taxable Income line 7 Over 0 65250 148350 But not over Pay--of the amount. Rhode Island has an individual income tax. RI or Rhode Island Income Tax Brackets by Tax Year.

Employees must require employees submit state Form RI W-4 if hired in 2020 or. The West Virginia tax rate. 2022 Child Tax Rebate Program.

3 West Greenwich - Vacant land taxed at 1696 per thousand of assessed value. TAX DAY IS APRIL. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum.

State Tax Brackets. Start filing your tax return now. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of.

The average effective property tax rate in Rhode Island is the 10th-highest in the country though. The Rhode Island Division of Taxation has released the state income tax withholding tables for tax year 2020. Detailed Rhode Island state income tax rates and brackets are available on this page.

Exemption Allowance 1000 x Number of Exemptions. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. Rhode Island state income tax rate table for the 2020 - 2021 filing season has three income tax brackets with RI tax rates of 375 475 and 599 for Single Married Filing Jointly.

A list of Income Tax Brackets and Rates By Which You Income is Calculated. Detailed Rhode Island state income tax rates and brackets are available on this page. RI-1040 line 8 or Over But not over RI-1040NR line 8 0 66200.

Detailed Rhode Island state income tax rates and brackets are available on. TAX DAY IS APRIL. Soldier For Life Fort Campbell.

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up. 3 rows Rhode Islands income tax brackets were last changed one year prior to 2020 for tax year. The state does tax Social Security benefits.

Property Taxes Urban Institute

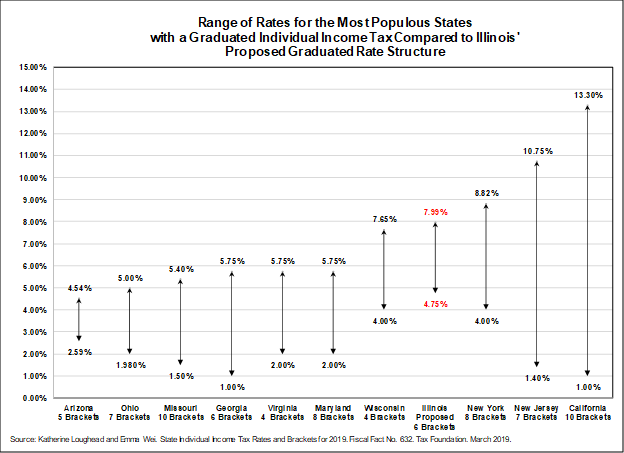

Marginal Tax Rates For Pass Through Businesses By State Tax Foundation

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

Riddc It S Tax Time Tax Credit Information And Also Free Tax Preparation Service Is Available To See A List Of The 2021 Vita Sites In Rhode Island Click This Link Http Www Economicprogressri Org Index Php Volunteer Income Tax Assistance Vita

Rhode Island Income Tax Ri State Tax Calculator Community Tax

State W 4 Form Detailed Withholding Forms By State Chart

Ri Health Insurance Mandate Healthsource Ri

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Tobacco Use In Rhode Island 2020

Rhode Island S Funding Formula After Ten Years Education Finance In The Ocean State Rhode Island Public Expenditure Council

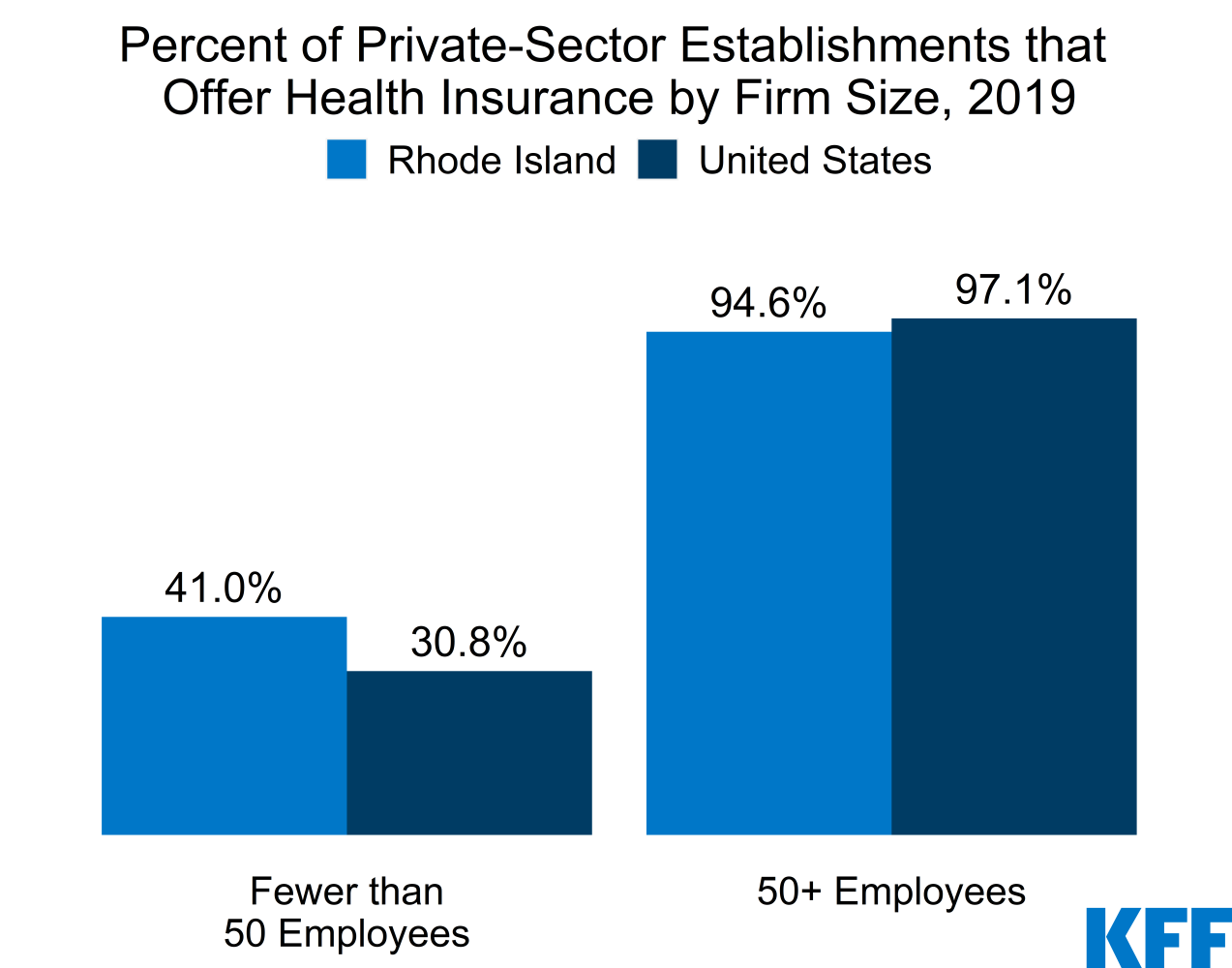

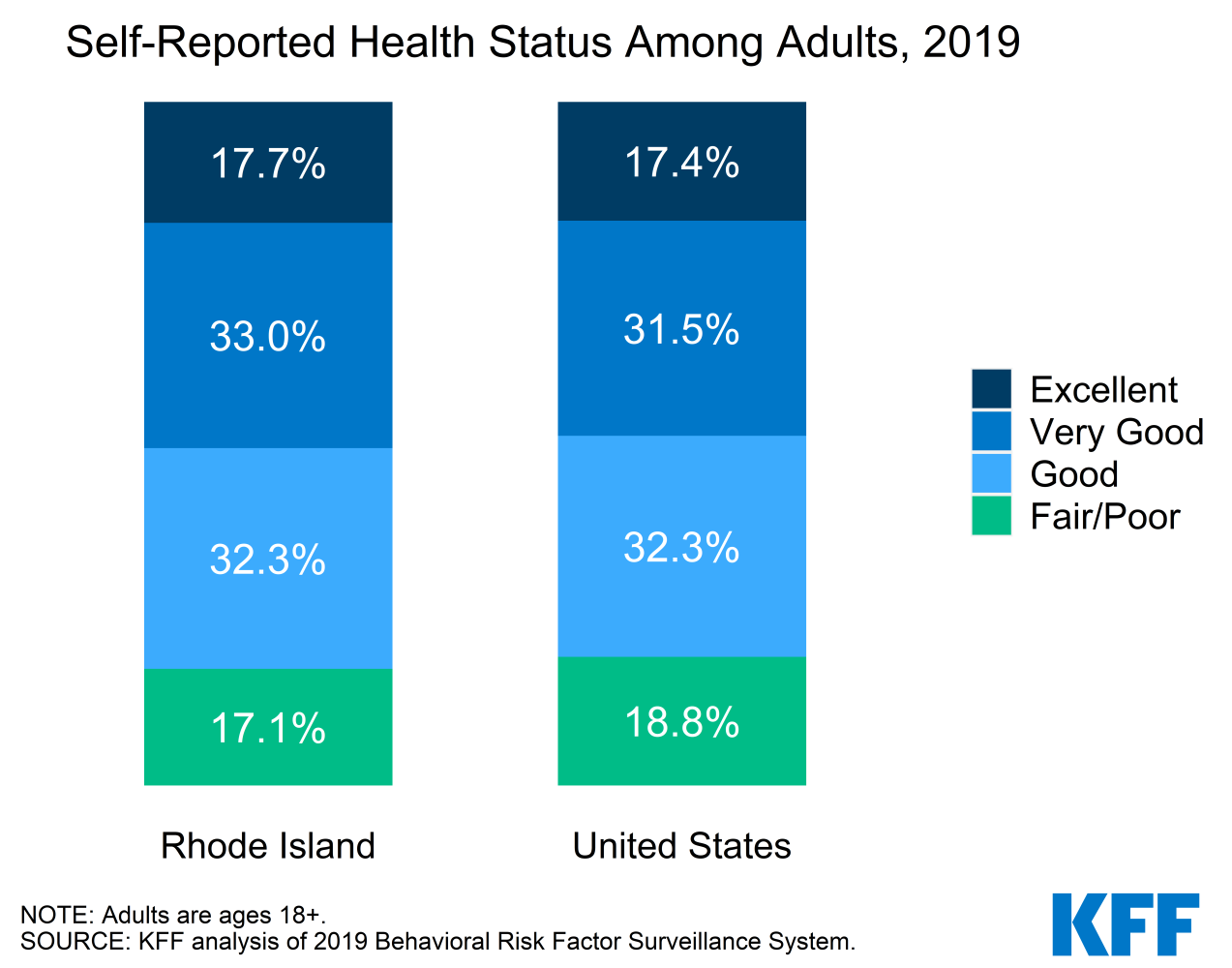

Election 2020 State Health Care Snapshots Rhode Island Kff

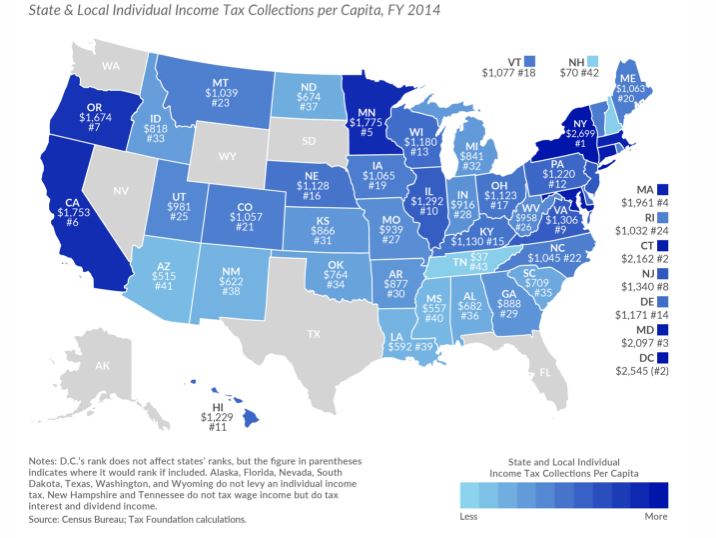

R I State And Local Income Tax Per Capita 2nd Lowest In New England

Historical Rhode Island Tax Policy Information Ballotpedia

Election 2020 State Health Care Snapshots Rhode Island Kff

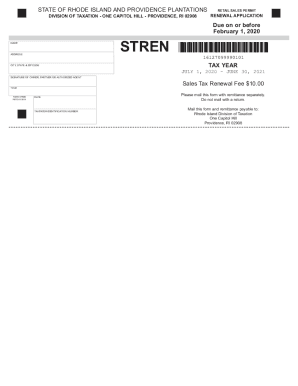

Ri Retail Sales Permit Renewal Fill Out And Sign Printable Pdf Template Signnow